All Categories

Featured

Table of Contents

Repayments can be paid monthly, quarterly, every year, or semi-annually for a guaranteed amount of time or permanently, whichever is specified in the contract. Only the interest portion of each settlement is thought about gross income. The remainder is taken into consideration a return of principal and is without income tax obligations. With a postponed annuity, you make normal costs settlements to an insurance provider over a time period and enable the funds to construct and earn passion during the build-up phase.

A variable annuity is an agreement that provides varying (variable) instead than set returns. The essential feature of a variable annuity is that you can control exactly how your costs are invested by the insurance coverage company.

The majority of variable annuity agreements provide a selection of professionally managed profiles called subaccounts (or financial investment alternatives) that buy supplies, bonds, and cash market instruments, along with well balanced financial investments. Several of your payments can be positioned in an account that uses a set rate of return. Your costs will certainly be assigned among the subaccounts that you choose.

These subaccounts rise and fall in value with market conditions, and the principal may deserve essentially than the original expense when surrendered. Variable annuities give the twin benefits of financial investment versatility and the possibility for tax obligation deferral. The tax obligations on all passion, dividends, and resources gains are deferred till withdrawals are made.

Exploring the Basics of Retirement Options A Closer Look at How Retirement Planning Works Defining Fixed Index Annuity Vs Variable Annuity Features of Fixed Indexed Annuity Vs Market-variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuity A Beginner’s Guide to Annuities Variable Vs Fixed A Closer Look at How to Build a Retirement Plan

The syllabus, which has this and various other information regarding the variable annuity agreement and the underlying investment options, can be obtained from your financial expert. Be sure to read the syllabus thoroughly prior to determining whether to invest. The details in this e-newsletter is not intended as tax obligation, lawful, financial investment, or retirement recommendations or referrals, and it may not be counted on for the purpose of avoiding any government tax obligation penalties.

The content is acquired from resources thought to be accurate. Neither the information offered nor any opinion expressed makes up a solicitation for the acquisition or sale of any security. This material was written and prepared by Broadridge Expert Solutions. 2025 Broadridge Financial Solutions, Inc.

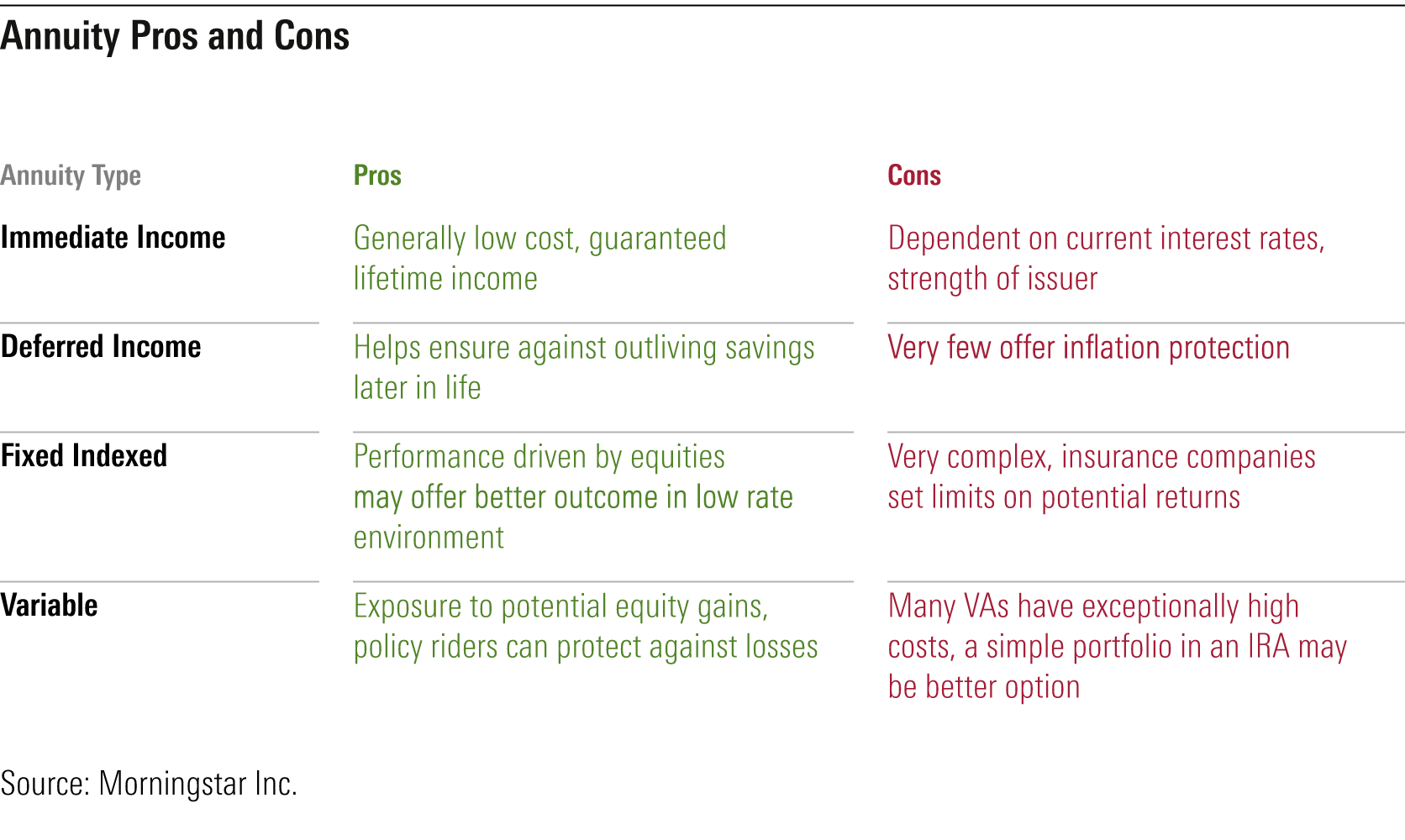

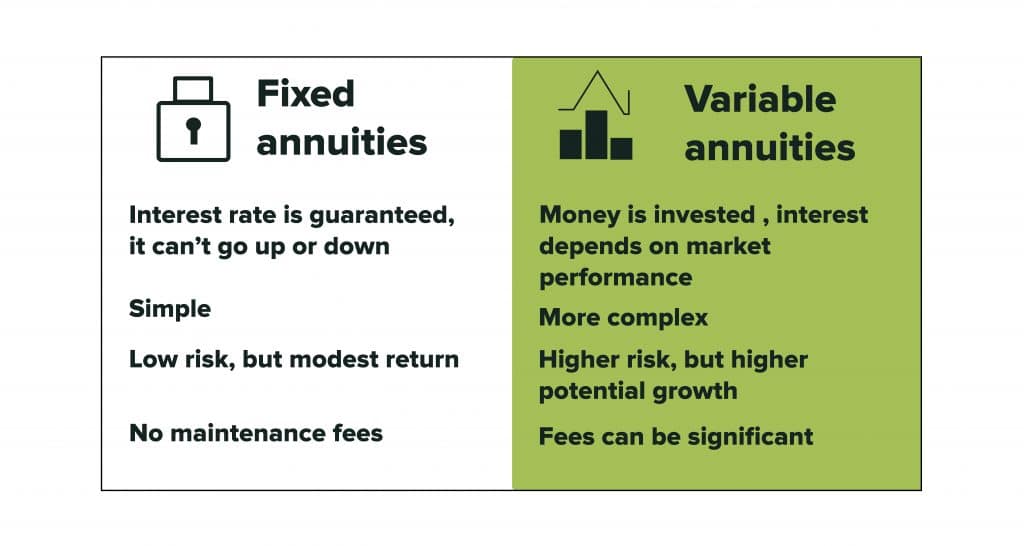

Two of the most usual choices include taken care of and variable annuities. The primary difference between a fixed and a variable annuity is that fixed annuities have actually a set rate and aren't tied to market performance, whereas with variable annuities, your eventual payout depends on how your selected investments perform. A set annuity offers you a predetermined price of return, which is established by your insurer.

You can choose exactly how much cash you wish to contribute to the annuity and when you desire to start obtaining income payments. Typically speaking, dealt with annuities are a foreseeable, low-risk means to supplement your income stream. You can money your dealt with annuity with one round figure, or a series of repayments.

You can money a fixed or variable annuity with either a lump sum, or in installations over time. Most of the time, variable annuities have longer accumulation durations than dealt with annuities.

Understanding Fixed Income Annuity Vs Variable Annuity Key Insights on Fixed Vs Variable Annuities Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Benefits of Variable Vs Fixed Annuity Why Variable Vs Fixed Annuities Is Worth Considering What Is Variable Annuity Vs Fixed Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of What Is A Variable Annuity Vs A Fixed Annuity Who Should Consider What Is Variable Annuity Vs Fixed Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at How to Build a Retirement Plan

Both repaired and variable annuities give you the chance to go into the annuitization stage, which is when you get cash from your annuity. With fixed annuities, you'll get earnings in taken care of installations that are guaranteed to stay the exact same.

This could be ten years, two decades, or permanently. The surrender period is the time structure during which you can not withdraw funds from your annuity without paying extra fees. Surrender durations usually relate to just delayed annuities so they can use to both dealt with delayed annuities and variable annuities.

Living advantages impact the earnings you receive while you're still active. For instance, you could desire to add an assured minimum buildup worth (GMAB) motorcyclist to a variable annuity to guarantee you won't lose cash if your financial investments underperform. Or, you could desire to include a price of living adjustment (SODA) motorcyclist to a dealt with annuity to help your payment amount stay on top of rising cost of living.

If you would certainly such as to start receiving revenue settlements within the next 12 months, an instant set annuity would likely make even more sense for you than a variable annuity. You might consider a variable annuity if you have more of a resistance for risk, and you would love to be a lot more hands-on with your investment option.

Among these differences is that a variable annuity may provide payout for a lifetime while shared funds might be diminished by withdrawals on the account. Another crucial difference is that variable annuities have insurance-related expenses and mutual funds do not. With all of the significant and small differences in repaired annuities, variable annuities, and shared funds, it is very important to speak with your financial advisor to guarantee that you are making clever cash choices.

In a dealt with annuity, the insurance policy business guarantees the principal and a minimum interest rate. In other words, as long as the insurance provider is economically sound, the cash you have in a dealt with annuity will certainly expand and will certainly not decrease in worth. The growth of the annuity's value and/or the advantages paid may be repaired at a buck amount or by a passion price, or they may expand by a defined formula.

Breaking Down Fixed Indexed Annuity Vs Market-variable Annuity Key Insights on Your Financial Future What Is Choosing Between Fixed Annuity And Variable Annuity? Advantages and Disadvantages of Immediate Fixed Annuity Vs Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: A Complete Overview Key Differences Between Variable Annuity Vs Fixed Annuity Understanding the Rewards of Fixed Vs Variable Annuities Who Should Consider Variable Vs Fixed Annuities? Tips for Choosing Fixed Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Many variable annuities are structured to offer financiers numerous different fund options. An equity-indexed annuity is a type of taken care of annuity, but looks like a hybrid.

This withdrawal adaptability is accomplished by adjusting the annuity's value, up or down, to show the adjustment in the passion price "market" (that is, the general level of rates of interest) from the begin of the chosen time duration to the moment of withdrawal. Every one of the list below types of annuities are available in taken care of or variable kinds.

The payout may be an extremely long time; postponed annuities for retirement can stay in the deferred phase for years. An immediate annuity is developed to pay an income one time-period after the immediate annuity is purchased. The time duration relies on exactly how commonly the earnings is to be paid.

Highlighting Fixed Vs Variable Annuity Pros Cons A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity Defining Fixed Annuity Vs Equity-linked Variable Annuity Pros and Cons of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy Matters for Retirement Planning Annuities Variable Vs Fixed: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Immediate Fixed Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Immediate Fixed Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuity Pros Cons

A set duration annuity pays an income for a specified duration of time, such as 10 years. The quantity that is paid does not rely on the age (or continued life) of the individual who purchases the annuity; the settlements depend instead on the amount paid right into the annuity, the size of the payout period, and (if it's a fixed annuity) a rates of interest that the insurer believes it can sustain for the size of the pay-out duration.

A variation of lifetime annuities continues revenue up until the 2nd a couple of annuitants passes away. No other sort of monetary item can guarantee to do this. The amount that is paid depends upon the age of the annuitant (or ages, if it's a two-life annuity), the amount paid right into the annuity, and (if it's a fixed annuity) a rates of interest that the insurance provider thinks it can sustain for the size of the anticipated pay-out period.

Numerous annuity buyers are uncomfortable at this opportunity, so they add a guaranteed periodessentially a fixed period annuityto their life time annuity. With this mix, if you die prior to the fixed duration ends, the income remains to your recipients up until completion of that duration. A professional annuity is one utilized to spend and pay out cash in a tax-favored retirement, such as an IRA or Keogh strategy or plans regulated by Internal Income Code areas, 401(k), 403(b), or 457.

Table of Contents

Latest Posts

Analyzing Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Pros And Cons Of Fixed Annuity And Variable Annuity Defining Fixed Index Annuity Vs Variable Annuity Benefits of

Exploring Fixed Income Annuity Vs Variable Growth Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Advantages and Disadvantages of Choosing Between Fixed Annuity And

Breaking Down Fixed Income Annuity Vs Variable Annuity Everything You Need to Know About Deferred Annuity Vs Variable Annuity Defining What Is A Variable Annuity Vs A Fixed Annuity Benefits of Choosin

More

Latest Posts